massachusetts commercial real estate tax rates

Ad Unsure Of The Value Of Your Property. If youre wondering what is the mill rate or what.

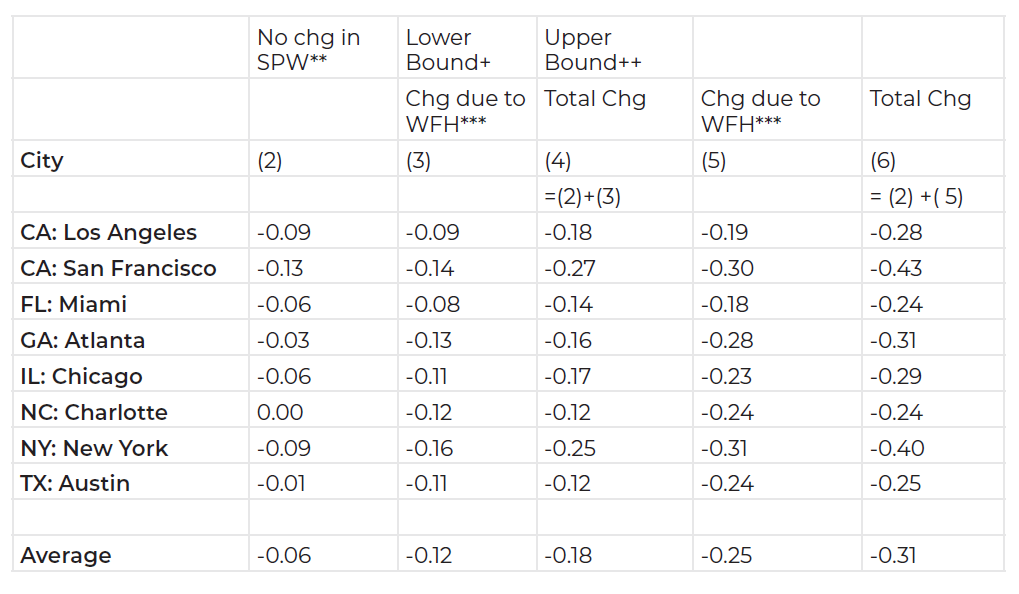

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

. Here you will find a town by town list of. Choose The CRE Mortgage that Fits Your Business Needs. FY2021 Commercial Tax Rate.

104 of home value. Choose The CRE Mortgage that Fits Your Business Needs. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor.

2012 per thousand of assessed value. The assessed value multiplied by the real estate tax rate. Town of Milford Massachusetts 52 Main Street Milford MA 01757 Town Hall.

Property Taxes Explained. Town of Hanover 550 Hanover Street Hanover MA 02339 7818265000 Statement on Community Inclusiveness Website Disclaimer Hours Directions Government Websites by. Fiscal Year 2022 Tax Rates.

2639 per 1000 of assessed value. The Tax Rate is set by the Select Board. Find All The Assessment Information You Need Here.

The Fiscal Year 2021 commercial tax rate for the Town of Wilmington MA is 3143 per 1000 of your propertys assessed value. Ad Get a Commercial Real Estate Loan From The Top 7 Lenders. 345 Main Street.

Ad 1 in Commercial Real Estate Online Search Commercial Properties Now. Grow Your Business Now. Public Disclosure Fiscal 19 Announcement.

Here you will find a town by town list of property tax rates in Massachusetts. These rates are per 1000 of assessed value. MassachusettsProperty Tax Rates changes every year.

Real Estate Commercial 2664. The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915. Property Tax Classification Hearings.

The median commercial tax rate increased in 2020. Ad Get a Commercial Real Estate Loan From The Top 7 Lenders. Commercial Industrial Personal Property.

Below are the 2021 Tax Rates from. 6 hours agoTransfer taxes. The seller usually covers the cost of real estate transfer taxes in Massachusetts at the rate of 228 for every 500 of value.

Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate. Tax amount varies by county. 351 rows How Are Massachusetts Property Tax Rates Calculated.

Norwell Personal Real Estate Tax Exemptions. The amount raised in property. Property tax rates are also referred to as property mill rates.

The three Worcester County towns with. 352 rows Massachusetts Property Tax Rates 2021 Residential and Commercial. Ad Our free guide may help you get the facts before taking the dive.

Short or Long Term. Grow Your Business Now. 370 rows Massachusetts Property Tax Rates by Town.

The law limits the amount of property taxes a city or town can raise in two ways. Tax Rate from FY 1921 to Present. Subscribe to Mayor Fullers E-mail.

The median residential tax rate for the. Commercial Industrial Personal Property Tax Rate. Real Estate and Personal Property Tax.

Massachusetts Property and Excise Taxes. On a 600000 sale that adds up to. 1227 per 1000 of assessed value.

Massachusetts voters passed the ballot initiative in 1980. Real Estate Residential 995. Datawrapper Residential tax rates decreased on average in Massachusetts for 2020.

Water Sewer Bill. Short or Long Term.

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

2021 Property Tax Rates For Berkshire County Berkshirerealtors

Investing Rental Property Calculator James Baldi Somerset Powerho Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Real Estate Pr Investing Real Estate Postcards Real Estate Infographic

Massachusetts Single Family Homes Put Under Agreement Up In December Massachusetts Association Of Buyer Agents Real Estate Investment Property Real Estate Marketing

Steep Discounts For Hong Kong Foreclosed Homes May Portend Property Price Slump Property News Top Stories The S Foreclosed Homes How To Buy Land Hong Kong

State Corporate Income Tax Rates And Brackets Tax Foundation

The Official Site Of Town Of Northborough Ma Places New England Favorite Places

Boston S Tax Rates Set For Fy21 Boston Municipal Research Bureau

Ameriprise Financial Looking For Something Real Estate Values Homeowners Insurance Homeowner

Properties Commercial Real Estate Realty Property

2022 Property Taxes By State Report Propertyshark

Real Estate Personal Property Tax Information Town Of Arlington

Real Estate Spring Market Home Selling Tips Spring Buying Your First Home

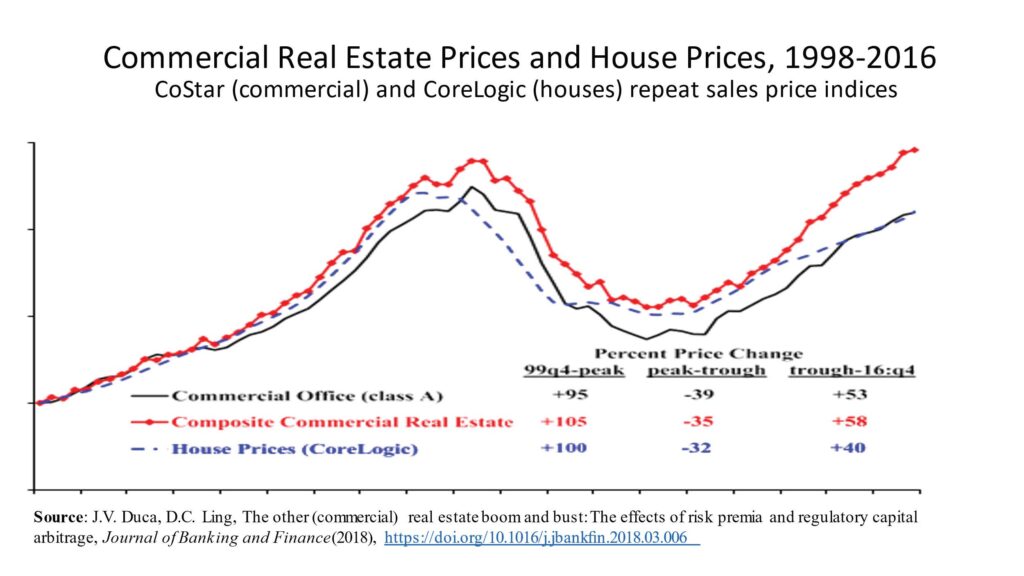

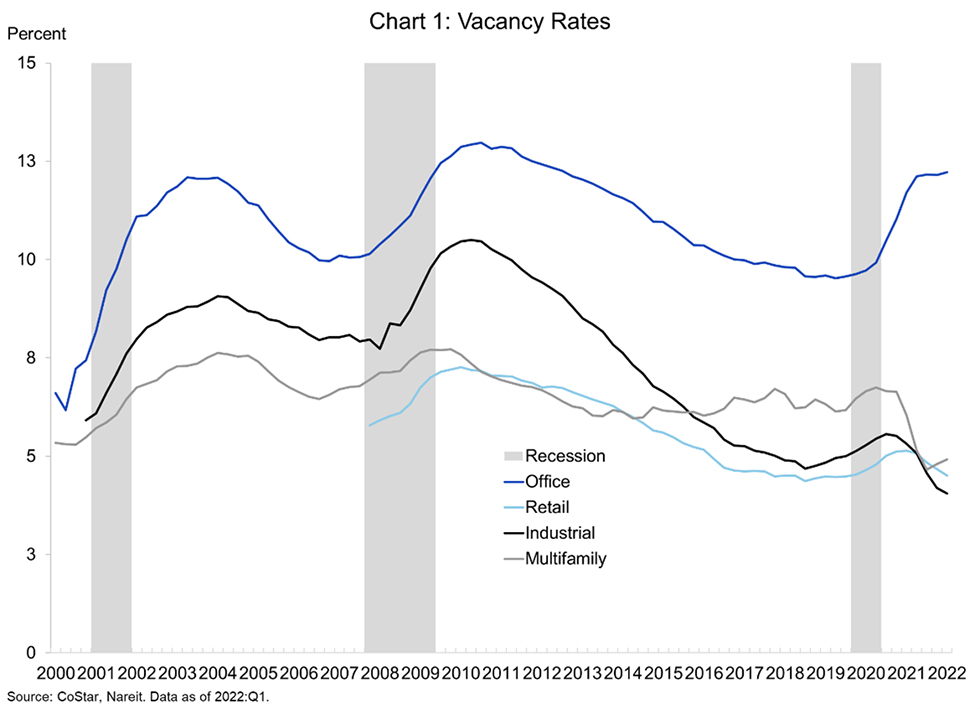

Commercial Real Estate Performance Remained Strong In The First Quarter Of 2022 Nareit

Easy Real Estate Commission Calculator Rentspree Blog

Applying Cost Segregation On A Tax Return The Wealthy Accountant Tax Reduction How To Apply Tax

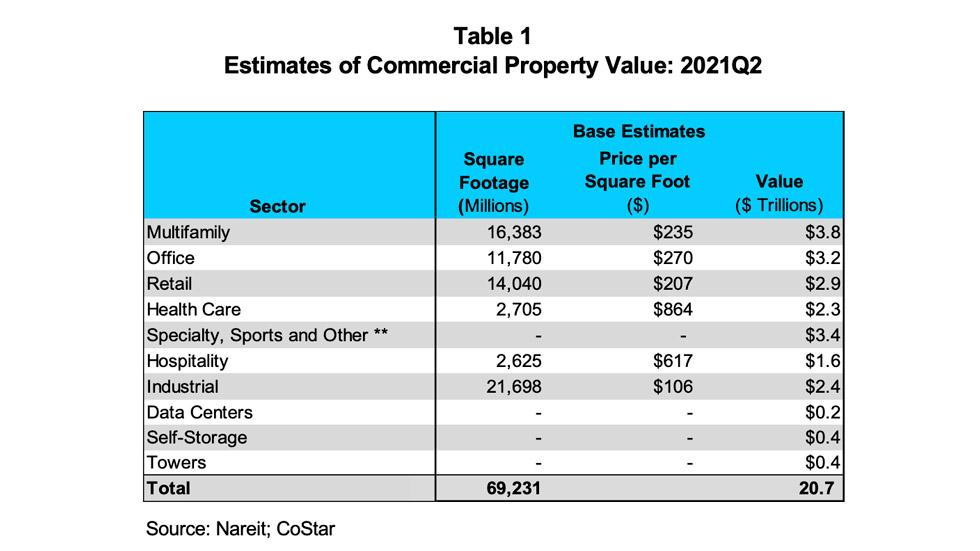

Estimating The Size Of The Commercial Real Estate Market Nareit

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices